Continuing our webcast series on COVID-19’s implications on various industries, on 27 May we looked at navigating the pandemic cycle for technology firms and the sharing economy in Asia.

Joining me on the panel were:

Alexander Chao, Communications, Media & Technology Industry Leader, Asia

Laura Biddell, Sharing Economy Industry Leader, Asia

Darrick Cheung, Client Engagement and Development Leader, Client Advisory Services, Asia

Dennis Dalati, Claims Advocacy Leader, Asia

Rohan Muralee, Mercer Marsh Benefits Sales Leader, Asia

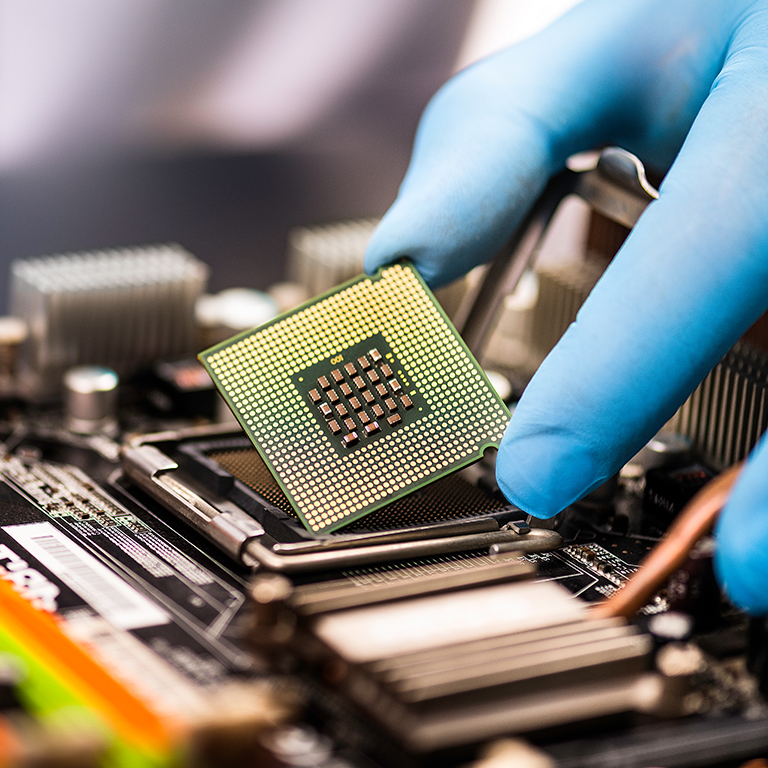

Technology Firms

While technology companies have to protect business continuity and employees’ safety during the pandemic, Alexander shared that the crisis has accelerated the need for globally available digital infrastructure and solutions.

Near-term pains for some tech companies are unavoidable, but other opportunities are arising. For example:

- Decreased demand for some devices, hardware, or components like new smartphones but increased demand for laptops due to the needs of working from home.

- Revenue losses for Sharing Economy companies focused on transportation and travel but software and IT businesses are growing from the demand of the At Home economy such as video games, online videos, and online education.

- For telecommunications, international roaming business slowed down but demand has increased for faster network connection.

To ensure business continuity, companies should act now on these three fronts:

1. Supply chain

Although China has eased restrictions of domestic travel, other major original equipment manufacturer (OEM) or original design manufacturer (ODM) countries such as India, Thailand, Vietnam, Malaysia, Philippines, and Indonesia remain country-wide or partially locked down. Supply disruptions are compounded by lags in component supply, travel bans, and labor shortages.

It is thus vital for tech companies to maintain sufficient components and labor while competing for supplies and dealing with the higher costs borne by customers.

2. Employee safety

Employees’ health and safety remain the top of employers’ priorities, tech companies included. Many companies are taking no chances by implementing measures such as:

- Working from home.

- Segregating work hours.

- Splitting employees at premises into teams restricted to one worksite where applicable.

- Minimizing physical interactions whenever possible.

3. Market demand

The At Home economy during lockdown is turning into a new lifestyle movement.

Many e-commerce businesses are experiencing sizeable growth due to the consumer spending shift. The increased need for digital collaboration tools will likely drive demand for technology in many categories, such as data analytics, electronic records, intelligent voice calls, enterprise cloud service platforms, and control data systems.

With telecommuting a seismic shift for many firms, they experience higher exposures to cyber-attacks, and several tech companies have already been sieged in the past few weeks.

Sharing Economy

Greater China and Southeast Asia were among the first regions to experience the full-scale impact of COVID-19, with multiple industries and business verticals experiencing various positive and negative shifts in consumer behavior, as explained by Laura:

Gig workers exposed due to lack of benefits

Gig workers, classified as Independent Contractors and not employees, typically fall outside traditional models of insurance, leaving many underinsured or without paid sick leave, health insurance, or workers’ compensation.

78% of gig workers live paycheck to paycheck, and losing a day or two of work can make the difference between making decisions to pay rent, buy food, or pay bills.

There are thus many opportunities for new products and service models to better address the needs of this agile workforce.

Shift from furloughed employees to gig seeking earnings

Asia accounts for 40% of the world’s Unicorns. With a reduction in consumer mobility and travel, the sharing economy sector experienced 80 – 90% declines in revenues. Many tech giants and startups have had to let go of up to 25% of their full-time workforce to stay afloat.

Quick restructuring due to mobility restrictions

Global tech giants are now pausing investments that do not support their core businesses and focusing on working remotely, reducing the volume of offices, and continuing consolidation efforts.

Push to consolidate to survive, with an opportunistic eye on growth opportunities

Platforms are doubling down on services that are growing. For example, online shopping and food delivery apps in Southeast Asia have seen a 40% increase in Monthly Active Users in March, particularly for grocery deliveries and essential services. Food delivery apps alone have witnessed a 21% increase in new users during this time. One interesting factor is people have started “gifting” food to their family by ordering on their behalf.

Several leading platform players are considering acquiring their rivals to reduce competition and tap into the next big growth opportunity: “on-demand” food delivery.

Cost Savings

From a risk management and insurance perspective, businesses have several tools available to manage costs and improve cash flow. The approaches below were shared by Darrick and Dennis.

Speak with your Marsh broker if you believe you have a potential Business Interruption (BI) claim. We can help assess if the policy criteria are met and, subsequently, support the claims preparation work via our forensic accounting team (FACS).

Review Premiums

With likely changes to revenue figures, a thorough review of your business interruption values may potentially qualify you for a return premium or reduction to future premiums. Any material changes to either the manufacturing processes or business activities will have to be updated to your insurers, especially if there is a fundamental shift to new revenue streams as your exposure profile may have altered.

We recommend discussing this with your broker to determine viability.

Alternatively, we can identify your most economically efficient means to finance your risk through Risk Finance Optimization (RFO), which ultimately gives you information on which risk management programs provide the best financial returns. This process is thorough, so it is best to start this several months ahead of your renewal date.

Alternative Solutions

Alternative Risk Transfer options, such as Parametric Insurance, can be a long-term alternative strategy. The use of a captive may provide access to reinsurance markets and potentially more efficient capital.

We had already begun to see a significant shift in insurer pricing, with rating adjustments broadly impacting clients across most major lines and geographies. Therefore, an access to a wider market has the potential to unlock increased competition for risk transfer programs and provide greater transparency and visibility on how the reinsurance market is pricing risk.

Employee Wellbeing and Productivity

Rohan talked about how insurers have started offering innovative benefits such as telehealth facilities and the home delivery of medicine. While non-pandemic claims will be lower this year, we are expecting a spike next year, but in the long run, these advances should help drive down utilization and costs.

Many companies have reduced their number of staff or work hours, and they might rely on gig workers to fill capacity gaps. Organizations will need to think about how to provide benefits to a fluid workforce with a mix of full-time, part-time, contracted, and gig-worker employees.

As we slowly emerge from lockdown, companies will have to be prepared for employee wellbeing challenges, with key considerations like insurance coverage (outpatient, mental health, preventative, workers’ compensation) and any required policy extensions. They also need to consider their readiness to continue remote-working while ensuring continued productivity and engagement.

There are three important aspects of the recovery phase:

- Health and safety.

- Cost management.

- Ensuring productivity and engagement.

To support clients through this phase, Mercer and Marsh Risk Consulting have put together a framework that boils down to three key areas:

Returning to work safely: Ensure employees are safe commuting to work and at work. This includes worksite safety, social distancing, equipment disinfection, screening, and testing.

Returning to stability: Understand the cost of returning to work and providing the health and safety aspect.

Returning with energy: Provide additional support for mental health programs, wellness initiatives, and additional testing and screening, and in certain cases additional insurance coverage options.

Mercer Marsh Benefits has been successful in developing continuation benefits for health and COVID-19 treatment and support benefits, in addition to working with companies to plan their return-to-work strategy. Do contact us if you require such support.

Shifting Risk Profile

Darrick and Dennis shared the four areas companies should consider to manage their risk profile changes:

Business Continuity Plan Reviews and Updates

In the short and medium-term, the focus should be on:

- Staff safety and health: Safe distancing, screening protocols, adequate Personal Protective Equipment, active sanitation equipment, etc.

- Supply chain: Address issues in distribution channels and overreliance on single suppliers.

- Planning for recovery or when governments ease restrictions: adopting a phased recovery to a “new normal” of business operations.

Pandemic Risk Vulnerability Assessment and Forecasting Models

In the longer term, these assessments and models enable organizations to evaluate different risk mitigation strategies, manage tail uncertainty under different scenarios (e.g. second wave outbreaks), and balance revenue interruption versus cost control decisions.

Cyber Threats

The first 100 days of COVID-19 saw a 26–55% increase in cyber scams. With the increased risk of cyber-attacks, companies should financially quantify such new exposure changes and develop appropriate risk management strategies, which can include insurance.

Professional Liability

We expect Directors & Officers Liability (D&O) insurers to increase underwriting scrutiny, so engage with your broker or insurers as early and as openly as possible.

Dennis also added that many technology manufacturing clients could face risks associated with turning back on or ramping up production lines, given the host of new technologies involved in the industry now. For the sharing economy, the risks are more in regards to changes in consumer behavior and having to adapt to that rapidly, such as contact tracing, cleaning of equipment, or new health and safety protocols.

Insurers expect to see an increased number of claims on Employment Practices Liability (EPL) as rapidly evolving HR policies may not have been cross-checked and employees may allege discrimination or harassment.

Risk Management and Business Enablement

Darrick and Laura continued to outline how Marsh can provide immediate support through three primary activities:

- Preparedness assessment and advice as the crisis unfolds, for example, ongoing advice that BCPs are “Fit for Purpose”.

- Providing additional management capacity, including additional reviews and PMO support to navigate the crisis.

- Debriefing (lessons learned) to better prepare for the future.

Our consumer solutions team also develops insurance solutions that can be offered on a B2B2C basis across many industries, for example:

- Customer, driver, rider partners, and gig-workers engagement programs for companies.

- Employee benefits top-up programs for employers.

If you are interested in learning more about how Marsh can help, please speak to your Marsh representative.

Click here for the full replay of this webcast.