The Arabian-Nubian Shield is poised to become the next big mining destination, involving the economies of Egypt, Ethiopia, Saudi Arabia, and Sudan and holding copious deposits of materials deemed “strategically significant” across the globe. At almost three million square kilometres, the Arabian-Nubian Shield constitutes one of the world’s largest Precambrian rock formations. It stretches across nine countries from the eastern Nile basin to the Saudi highlands, including the whole maritime area leading to the Suez Canal. Strategic materials include chromite, cobalt, copper, manganese, nickel, niobium, tantalum, and uranium. Chromite is crucial for super alloys that form the basis of jet turbine engines, tantalum is vital to household electronics, and niobium is used to strengthen alloys designated for rockets and missiles.[1]

Establishing a share in the global production of these minerals potentially would bring immense wealth and international advantage, but the Arabian portion could develop faster than the Nubian side due to political risk. The Egyptian government, due to compounded economic stagnation, has seen policymakers roll back measures designed to deter foreign direct investment — no doubt a measure to better serve the formative stages of the mining sector. Mining operations could also drain water from the already contested Nile Basin that Egypt shares with Sudan and Ethiopia. Sudan is the third-largest exporter of gold among African nations, but the political situation remains unpredictable following a coup in October 2021. Indeed, the ease of access to gold deposits has provided insurgents with the funding to acquire arms and confront the central authorities. Ethiopia’s potential has increasingly drawn the attention of the international mining community, with export of minerals growing from US$9.6 million in 2015 to US$504.7 million in 2021.

However, the outbreak of the Tigray War has negatively affected Ethiopia’s standing on the world stage; the Tigray region roughly coincides with Ethiopia’s part of the Arabian-Nubian Shield. Mining enterprises hailing from Australia, China, Israel, and South Africa have all demonstrated interest of varying degrees in better understanding the full nature of the mining potential in the region.

Saudi Arabia’s mining industry is well placed to support this aspired demand, as there is enough mineral wealth in the country to aid its attempts to pivot its economic portfolio away from hydrocarbons. Policymakers seek to quadruple the mining sector’s GDP contribution by 2030, from US$17 billion to US$64 billion. Since the advent of Vision 2030, the state has passed about 400 updates to its policies — including new mining investment laws, streamlining license applications, and data sharing — as it seeks to reduce risks that investors could face.

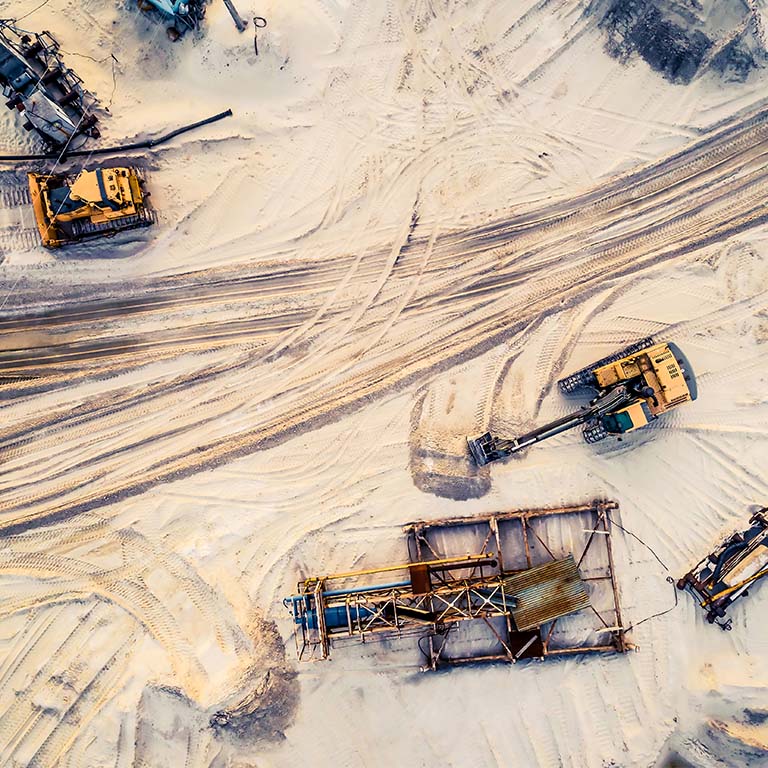

As we saw in 2021 when the Suez Canal was blocked by a mega-ship, one regional trigger can have serious consequences on existing frictions among countries and on global trade as a whole. As the Arabian-Nubian Shield gradually opens for business, social stability and policy predictability will tell which countries will be able to benefit from this mineral wealth, and which will not (see Figure 2).

Figure 2:

Political risk remains high in Sub-Saharan Africa across all perils, while Middle East and North Africa remain riskiest for personal and asset security.

[1] Though much of the Arabian-Nubian Shield remains underexplored, there is a benchmark to measure its overall mineral potentials. In the Saudi portion, decades of exploration by various organisations and companies has led to the discovery of more than 5,300 mineral prospects. For the most part, the Arabian-Nubian Shield shares the same geological evolution, so it is believed that the other nations hold undiscovered mineral sites that are in proportion to the respective territories.

Related articles

Article

Political risk at sea

21/03/2022

"This publication is not intended to be taken as advice regarding any individual situation and should not be relied upon as such. The information contained herein is based on sources we believe reliable, but we make no representation or warranty as to its accuracy. Marsh shall have no obligation to update this publication and shall have no liability to you or any other party arising out of this publication or any matter contained herein. Any modelling, analytics, or projections are subject to inherent uncertainty, and the analysis could be materially affected if any underlying assumptions, conditions, information, or factors are inaccurate or incomplete or should change."

LCPA: 22/136