Missing out on ESG risks can derail your enterprise risk management efforts. Don’t be caught by surprise.

Environmental, social, and governance (ESG) issues translate into complex and interconnected risks. To ensure ESG risks are appropriately managed as part of the overall risk portfolio, organisations must take right actions to identify and integrate ESG risks into their enterprise risk management (ERM) approach.

ESG-ERM integration should be a priority for your organisation, as an ESG-related risk event or crisis can occur anytime and reveal the "weakest link" in your risk posture, potentially resulting in serious revenue impact, enterprise-wide disruptions, financial penalties and liabilities, increased cost of capital, as well as eroding stakeholder confidence and enterprise value.

Given the potential consequences, Marsh Asia’s risk advisory team has developed a holistic and systematic approach to help you assess and integrate ESG risks into your ERM strategy effectively.

Your roadmap to integrating ESG-ERM starts here

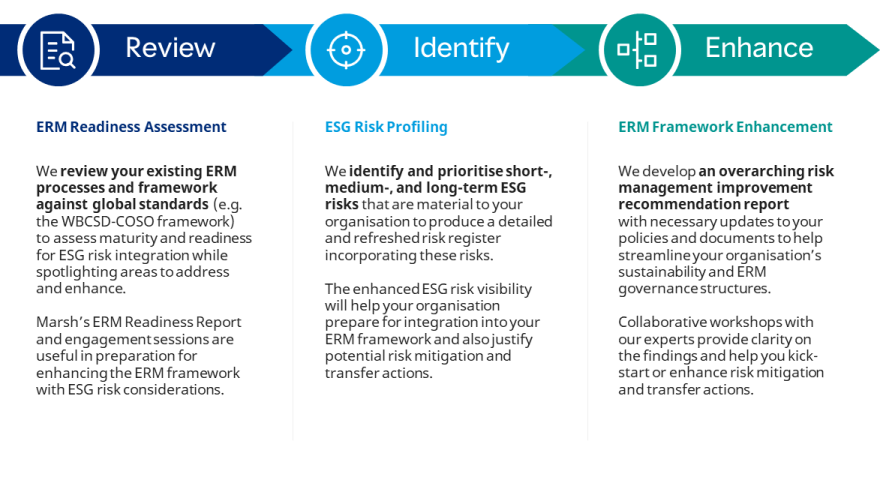

Our 3-step process is supported by our team of subject matter experts on ERM, climate and sustainability, as well as domain experts with in-depth risk knowledge across industries that is essential for risk scanning and discovery of risk ‘blind spots’ specific to your industry.

Marsh Asia’s 3-step ESG-ERM integration approach

For effective ESG-ERM integration, it is beneficial for organisations to partner with a trusted risk advisor as ESG and ERM functions are typically siloed, which may result in misalignment and missed opportunities to embed ESG risks, as well as overlook potential issues — such as the traceability of raw materials used and ethical labour practices, especially those with longer-term implications. With ESG risks managed as part of an integrated ERM program, organisations can use a common language to address their risk exposures and enhance resource allocation.

As there is no one-size-fits all approach to ESG-ERM integration, Marsh Asia’s guidance and recommendations are specifically tailored to your organisation’s risk appetite, management approach, and strategic outlook.

Why Marsh?

Marsh Asia excels in leveraging its deep industry and risk advisory expertise to accurately identify and assess physical climate risk and transition risk exposures and integrate ESG risks into ERM framework to deliver actionable insights and recommendations that enable your business to proactively manage, mitigate, and transfer these risks.